Should You Get Private Health Insurance?

- 360South

With cost of private health insurance increasing every year, many people are asking themselves “is it worth it?” The answer to that is “it depends”. Ultimately, this decision is both an emotional and financial one.

There are several factors to consider from a financial perspective when deciding to take out private health insurance – the ‘Medicare Levy Surcharge’, ‘Private Health Insurance Rebate’, the cost of the hospital insurance policy and ‘Lifetime Health Cover Loading’.

Depending upon your situation – it may not cost much more to have private health cover – making the decision easier to take out private health insurance a little easier.

The Medicare Levy Surcharge

Most Australian tax payers are required to pay a basic Medicare Levy (whether or not you have private health insurance). The Medicare Levy Surcharge is an additional levy, which applies to Australian taxpayers who do not have an appropriate level of private hospital insurance and who earn above a certain income. It is designed to encourage individuals to take out private hospital cover, and where possible, to use the private hospital system to reduce demand on the public Medicare system.

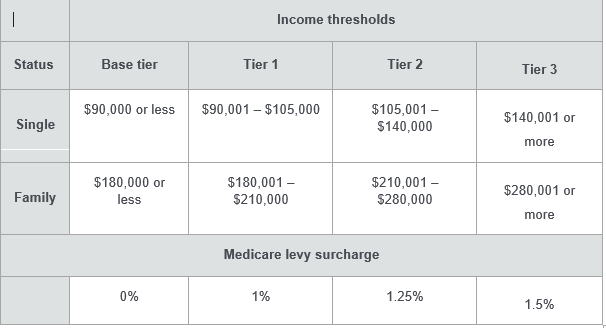

HOW MUCH IS THE MEDICARE LEVY SURCHARGE?

For the purpose of calculating the Medicare Levy Surcharge, “income” includes items in addition to normal income, such as rental losses, reportable fringe benefits and reportable super contributions.

Private Health Insurance Rebate

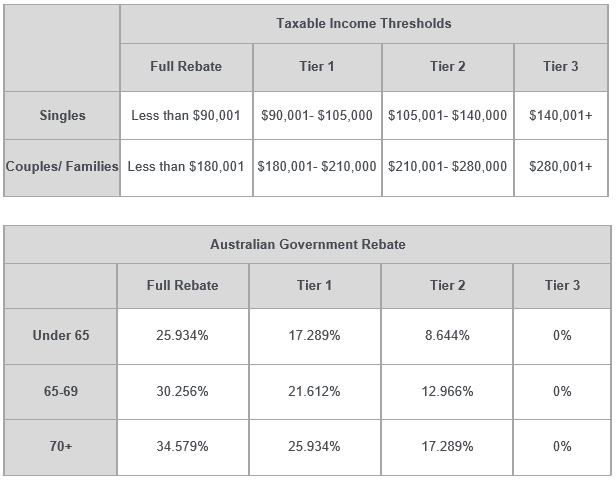

The private health insurance rebate is an amount the government contributes towards the cost of your private hospital health insurance premiums.

This rebate is income tested, which means your eligibility to receive it depends on your income. If you have a higher income, your rebate entitlement may be reduced, or you may not be entitled to any rebate at all.

The taxable income thresholds for 2015-16, 2016 -17 and 2017-18 [1] are: