How Much Money Are You Placing At Risk By Not Insuring Your Ability To Earn An Income?

- 360South

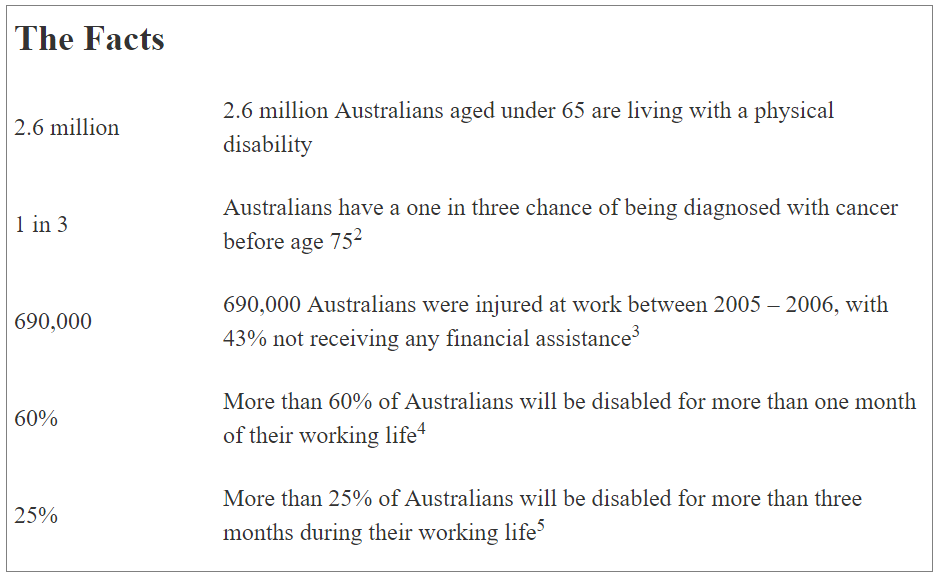

Not many people risk being uninsured when it comes to their car or home. But many choose to not insure their most valuable asset – that is, their ability to earn an income.

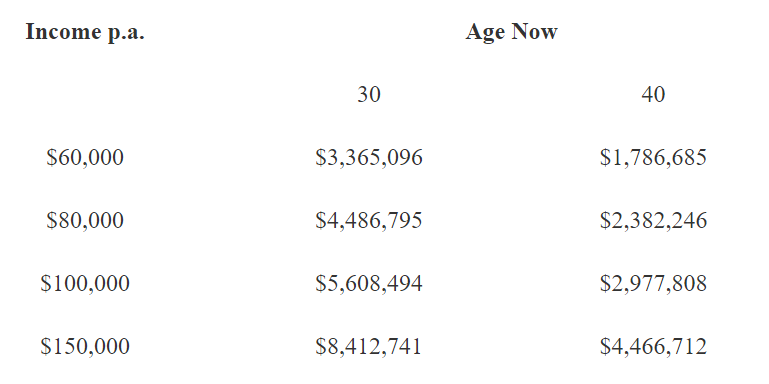

This is despite the fact that most people will earn a fortune between now and when they retire:

This means that most families are carrying significant financial risk should the unexpected happen. The big question you have to ask yourself is:

Would your family be able to maintain their lifestyle if you suddenly couldn’t earn an income due to a serious illness or accident?

If your answer to this question is no, you need to consider transferring that financial risk to an insurance company by purchasing income protection insurance.

Your financial adviser can help you do that, as well as answer any questions you have about income protection insurance, and then calculate how much you need to safeguard you and your family in the event something should happen to you or your spouse. And, if you wish, your adviser will use our sophisticated computer program to ‘broker’ the major insurers to find you the right cover at a competitive price*.

What is Income Protection Insurance?

Income protection insurance is designed to replace your income if you are unable to work due to sickness or injury. It provides a monthly payment of usually up to 75% of your pre-tax income, provides 24/7 cover, and whether the illness or injury happens at work is irrelevant. Its purpose is to provide you with a regular income to help you cover your living expenses so you can focus on your recovery. The premiums are tax deductible for most people.

What if you already have income protection through your employer?

Some people have basic income protection insurance through their employer. But this insurance generally pays a benefit for a maximum period of only two years and is a basic type of cover. This means if you are unable to return to work after two years you may not have a source of income.

In some instances it may therefore be appropriate to take an additional policy with a benefit period up to age 60 or 65.

How do the insurance companies view you as a risk?

Some insurance companies may charge you significantly less than other companies for the same cover, simply because they see you – or your occupation – as a lower risk. That’s why you should use a financial adviser who has the ability to ‘shop around’ the reputable insurers to get the best solution for your particular situation.

Case study

Steve and Petra have two children at school. They both work and they have a mortgage. They have a comfortable lifestyle but would struggle financially if one of their incomes was lost. We would recommend that both Steve and Petra purchase income protection policies which pay 75% of their pre-tax salaries up to age 65. If one of them were to suffer a serious injury or illness, that partner’s salary would be almost replaced by the insurance benefit – and therefore they could concentrate on getting better rather than worrying about where to find the money to pay the bills.

Sources:

1 AIHW (2008) Australia’s health 2008, Cat. no. AUS 99, Canberra.

2 AIHW (2008) Cancer in Australia: an overview 2008, Cancer series no. 46, Cat. no. CAN 42, Canberra.

3 ABS (2007) Australian Social Trends 2007, Cat. no. 4102.0, Canberra.

4 Fabrizio, E (2007) Australia & NZ Disability Income Experience www.actuaries. org/IAAHS/Colloquia/Cape_Town/Walker_-_Income_protection.pdf.

A5 AIHW (2008) Cancer in Australia: an overview 2008, Cancer series no. 46, Cat. no. CAN 42, Canberra.

*Insurance cover is subject to eligibility.