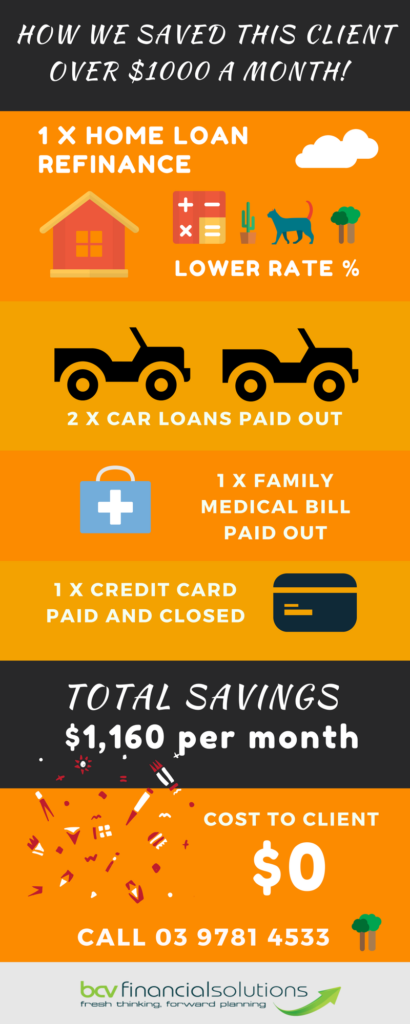

We recently organised a home loan refinance for one of our clients – which resulted in savings of over $1000 a month! The cost to the client was $0!

BCV Financial Solutions

3/72-76 Dandenong Rd West

Frankston, Victoria, 3199

POSTAL ADDRESS

PO Box 2663, Seaford, Victoria, 3198

Mon – Thur: 9am – 5pm

Friday: 9am – 4pm

After hours by appointment.

BCV Financial Solutions Pty Ltd is a Corporate Authorised Representative of Personal Financial Services Ltd ABN 26 098 725 145, AFSL 234459, Level 10, 88 Phillip Street, Sydney NSW 2000.