2018-2019 Federal Budget

- 360South

The Federal Treasurer Scott Morrison (or ‘ScoMo’ as he’s more affectionately known) delivered the 2018-19 Federal Budget on Tuesday night. The budget indicates an expected return to surplus in 2019-20. Amongst the pages of detail and myriad of changes handed down, we’ve summarised the key changes that we believe will impact most on individuals and small business.

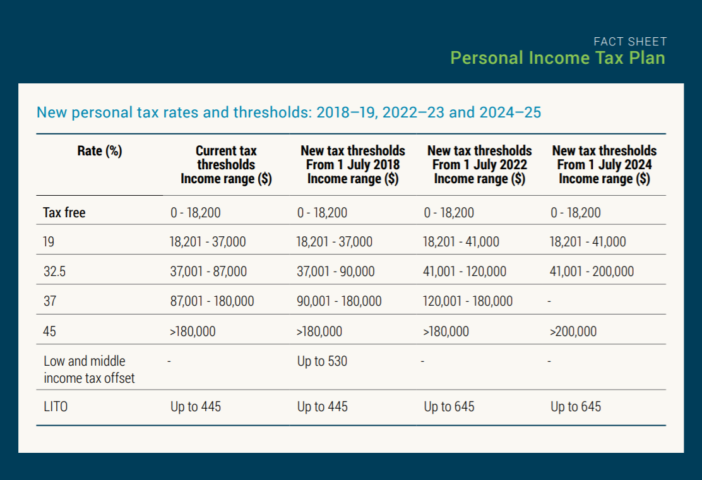

Tax Cuts: While there was little in the way of confirmed tax cuts for companies, individual taxpayers will benefit from a proposed raft of changes to tax thresholds and low income tax offsets, to take effect progressively over the next 7 years. These changes are summarised in the table below:

The proposed tax cuts are likely to benefit 10 million Australian taxpayers, possibly pointing to the announcement of an early election. The tax cuts will create a single tax rate of 32.5% for workers earning between $41,000p.a. and $200,000p.a. The flow on effect means that 94% of taxpayers will pay no more than 32.5c in the dollar (as opposed to 63% currently). All this at a cost of $140 billion over 10 years.

Medicare Levy:

A proposed increase in the Medicare Levy from 2.0% to 2.5%, that was announced in the 2017-18 budget and intended to take effect from 1 July 2019, has now been removed.

Small Business Asset Write-Off:

The provision allowing businesses with turnover of up to $10 million to immediately write-off assets costing less than $20,000 was extended for a further year.

Cash Economy:

Cash payments to business will be restricted to $10,000 or less. Any payments over $10,000 will need to be made via the banking system (electronically or via cheque). This is a clear crackdown on the cash economy, allowing the government to better track and cross-match payments to businesses with amounts declared in returns.

Work-Related Expenses:

The ATO crackdown on work-related expense claims is expected to continue, with the ATO handed significant extra funding to focus on these claims. Taxpayers be warned!

Deductions for Vacant Land:

Expenses associated with holding vacant land will cease to be deductible from 1 July 2019 and will not be able to be carried forward.

Such expenses for land that was previously vacant will only become deductible when:

- construction is complete, approval for occupancy has been granted and the property is available for rent, or

- the land is used in carrying on a business.

Superannuation:

The maximum number of members allowable in self-managed superannuation funds (SMSFs) and small APRA funds will increase from four to six from 1 July 2019.

SMSFs with a good record-keeping and compliance history will move from an annual audit to a three-yearly audit from 1 July 2019. To qualify the SMSF will be required to have three consecutive clear audit reports and lodged their annual returns on time.

From 1 July 2019, a three per cent annual cap on passive fees will apply to superannuation accounts where the balance is below $6,000. In addition, exit fees will be banned on all superannuation accounts.

Infrastructure:

The budget earmarked $5.1bn for a rail link to Melbourne Airport (finally!) and $500m for yet another upgrade of the Monash freeway/car park.

Possibly of interest to those from Frankston and surrounds, $225m was set aside for electrification of the Frankston railway line through to Baxter, meaning it will service Frankston Hospital and Monash University. I guess this means Frankston will no longer be the end of the line, and that has to be a good thing!

Finally, something a little more obscure, with the Government reducing the excise rate on craft beer. Surely good news for all, provided the cut is passed on to consumers!

As with any budget, none of the announcements are confirmed until the necessary legislation changes are approved by both houses of Parliament.

Note of course that any of the information above is general in nature. Its impact on you individually should be discussed with an adviser.