resources

What is the best way to save for retirement?

For most people, superannuation is the most tax effective way to save for retirement. And, just as importantly, it is the most tax effective way to generate a retirement income

What are the tax advantages of super?

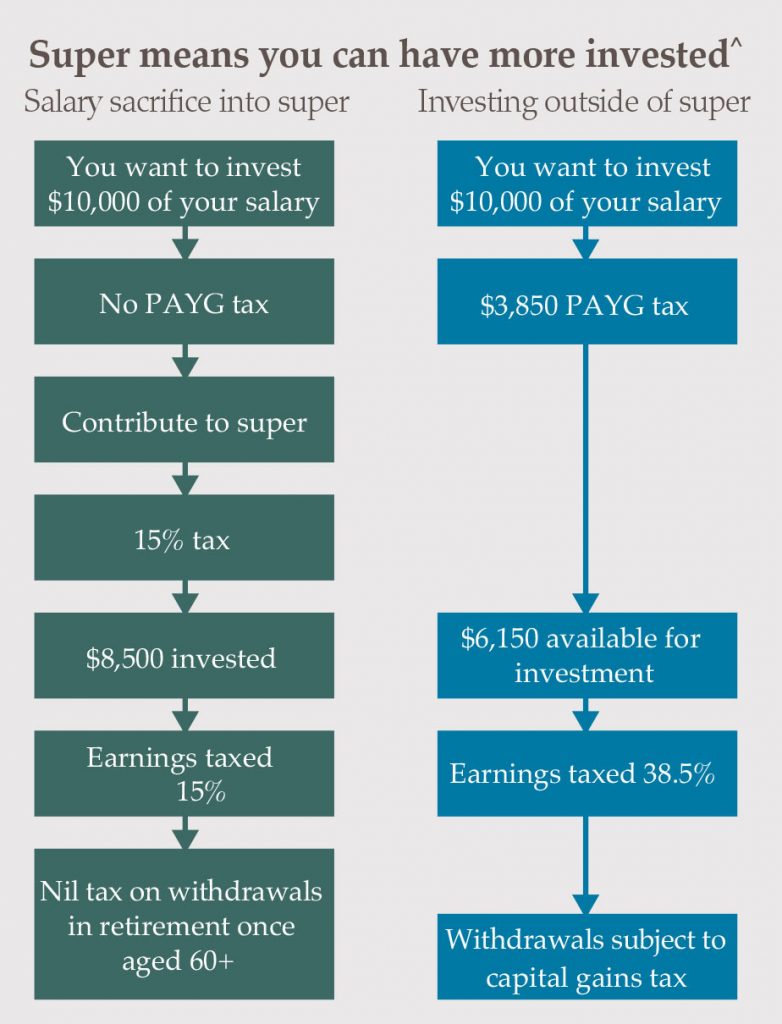

Let’s say you decide to invest $10,000 of your salary. If

you invest it via your super fund, from your pre-tax salary,

this is how your contribution will be taxed (assuming it is

part of a salary sacrifice arrangement):

• Firstly you won’t have to pay PAYG tax on the $10,000

of salary.

• But once in your super fund, tax of 15% will be levied,

leaving you with $8,500 invested.

Compare that to investing your $10,000 outside of super.

In that case, you’ll have to pay PAYG tax, leaving you with

just $6,150 (assuming your marginal tax rate is 38.5%) for

investment wherever you like.

*Assumes MTR 38.5% based on 2013/14 tax rates

The earnings generated by the investments outside

of super will be taxed at 38.5%. However, earnings

generated by investments in your super fund will be

taxed at only 15%.

Case study

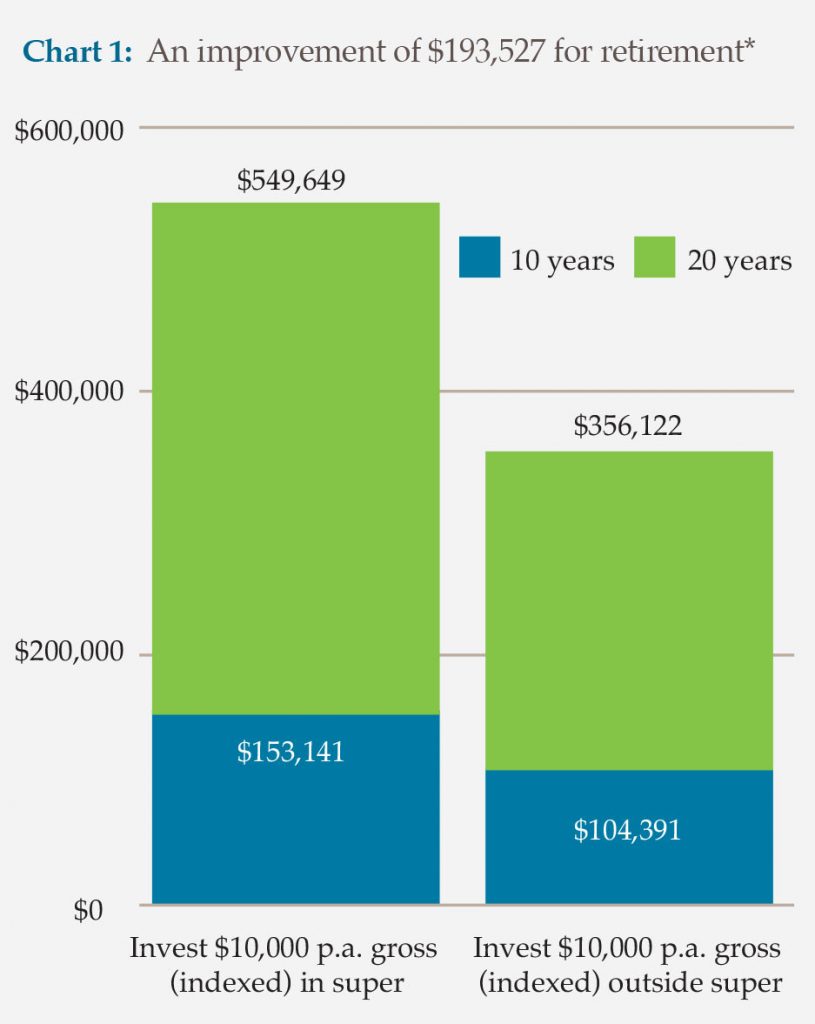

The tax differential between investing in super and nonsuper adds up over time. Let’s say Bob is on a tax rate of

38.5%, can afford to invest $10,000 p.a., and his salary

and investment contribution is indexed at 3% p.a. If he

invests that money in superannuation as part of a salary

sacrifice arrangement (i.e. $8,500 after contributions tax)

and the fund earns 8% p.a. gross, he would accumulate

$153,141 after 10 years, and $549,649 after 20 years, as

shown in Chart 1.

*Assumes MTR 38.5% and an investment return of 8% p.a. gross

However, if Bob chooses to not use superannuation, he’ll have only $6,150 p.a. (indexed) to invest after paying PAYG tax. And he will be paying tax on investment income of 38.5% (compared to 15% in super). As a result, after 10 years he’ll accumulate only $104,391, and after 20 years $356,122, assuming an 8% p.a. gross return.*

The sole reason for the difference is the preferential tax treatment of superannuation.

How much can you invest in super on a tax-effective basis?

Because super is tax advantaged, there is a limit on how much you can invest in super and qualify for a tax

Super Pros

- Low tax on contributions

- Low tax on earnings in the fund

- Little or no tax on retirement income (if finances properly arranged)

deduction. This limit is shown below, and it includes your employer’s super guarantee contributions.

Tax Deductible Limit (2013/14)

Under age 60 $25,000 p.a.

Age 60+ $35,000 p.a.

No tax for retirees in super and aged 60+

Superannuation has become even more tax effective for retirees due to a recent rule change. The change means that for most retirees over age 60, there is now no tax on withdrawals from super, and no tax on income or withdrawals from account based pensions.

Super Cons

- Generally you can’t withdraw money until you are 55+ and retired (but you may be able to start a pension from your super money after age 55 even if you are still working)

- Rules are complex and subject to change

Who is Australian Unity Personal Financial Services?

However, if Bob chooses to not use superannuation, he’ll have only $6,150 p.a. (indexed) to invest after paying PAYG tax. And he will be paying tax on investment income of 38.5% (compared to 15% in super). As a result, after 10 years he’ll accumulate only $104,391, and after 20 years $356,122, assuming an 8% p.a. gross return.*

The sole reason for the difference is the preferential tax treatment of superannuation.

How much can you invest in super on a tax-effective basis?

Because super is tax advantaged, there is a limit on

how much you can invest in super and qualify for a tax

- Commercial loans

- Investment loans

- Equipment finance

- Car finance

- Personal estate planning

- Business estate planning

- Personal risk insurance

- Business risk insurance.

Any advice in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. You should obtain financial advice relevant to your circumstances before making investment decisions. Where a particular financial product is mentioned you should consider the Product Disclosure Statement before making any decisions in relation to the product. Whilst every care has been taken in the preparation of this information, Australian Unity Personal Financial Services Ltd does not guarantee the accuracy or completeness of the information. Australian Unity Personal Financial Services Ltd does not guarantee any particular outcome or future performance. Australian Unity Personal Financial Services Ltd is not a registered tax agent. If you intend to rely on any tax advice in this document you should seek advice from a registered tax agent. Australian Unity Personal Financial Services Ltd ABN 26 098 725 145, AFSL & Australian Credit Licence No. 234459, 114 Albert Road, South Melbourne, VIC 3205. This document produced in November 2013. © Copyright 2013.