resources

What is a Self Managed Super Fund?

A Self Managed Super Fund (SMSF) is a fund designed to hold and distribute retirement benefits for its members. These funds are controlled by their members, and may have no more than four members.

Why use an SMSF?

SMSFs currently hold 24.7 percent of all money invested in super by Australians*. The main attractions of SMSFs are that you have control over where your super money is invested, and they can help you create additional tax efficiencies and save on administration fees.

What is the trustee’s role?

The trustee is responsible for establishing the trust deed, setting and maintaining the fund’s investment strategy, finalising reporting obligations, lodging APRA and tax returns, payment of levies and taxes, and compliance with APRA and Taxation Office laws and regulations.

Trustees who are found to be in breach of these duties can be fined and, in extreme cases, gaoled.

With an SMSF, there can be individual member trustees or a company acting as trustee. For individual member trustees, every member must be a trustee and all trustees must be members.

Where there is a company acting as trustee, all company directors must be members and all members must be directors.

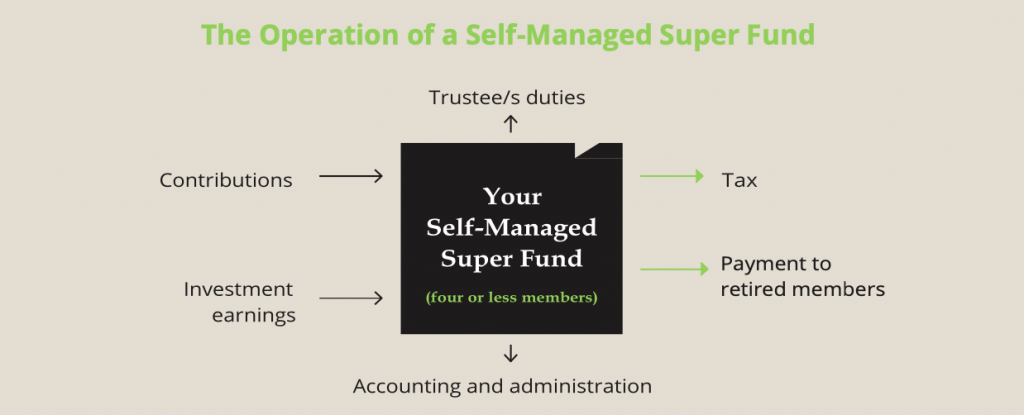

How does an SMSF work?

An SMSF works much the same as a large retail superannuation fund. It accepts contributions from members and invests and manages those contributions and subsequent earnings.

It is responsible for paying tax and making payments to members who are retired (i.e. lump sums and pension payments).

There are also administrations and accounting tasks which need to be completed to ensure all members’ records are correct, the correct taxes are paid, and the fund remains compliant with all relevant laws and regulations.

Trustees who are found to be in breach of these duties can be fined and, in extreme cases, gaoled.

With an SMSF, there can be individual member trustees or a company acting as trustee. For individual member trustees, every member must be a trustee and all trustees must be members.

Where there is a company acting as trustee, all company directors must be members and all members must be directors.

Which assets can an SMSF invest?

An SMSF can invest in any assets allowed for by the fund’s investment strategy and super rules. These usually include:

• managed funds, shares and property

• cash and fixed interest

• business real property

What can’t an SMSF do?

There are some restrictions on what SMSFs are allowed to do and invest in. For example, the SMSF cannot lend money to members or relatives and cannot buy residential property from a related party.

Most importantly, the SMSF must be run to meet the sole purpose of providing retirement benefits for members.

An SMSF which contravenes the regulations risks being declared non-complying and losing its concessional tax status. The result would be all concessional contributions and earnings being taxed at 45 percent instead of at up to 15 percent.

Who can be in your SMSF?

The fund can include relatives such as your spouse, children and/or parents (up to a total of four members, although the government has proposed an increase to six members). One benefit is that fixed costs are shared by more members, thus creating additional cost savings per member.

What are the costs of running an SMSF?

An SMSF may have to pay fees for investments (e.g. brokerage), trustee services, accounting, administration and audits. An SMSF can be cheaper than a retail fund at higher balances, generally this may be the case if the fund has more than $500,000 invested but it depends on individual circumstances.

Is an SMSF right for you?

An SMSF could be right for you if you and/or your spouse have at least $250,000 to transfer into an SMSF and you think the advantages outweigh the disadvantages.

* As at March 2020, APRA report ‘Quarterly Superannuation Performance’ (issued 26 May 2020)

Any advice in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. You should obtain financial advice relevant to your circumstances before making investment decisions. Where a particular financial product is mentioned you should consider the Product Disclosure Statement before making any decisions in relation to the product. Whilst every care has been taken in the preparation of this information, Australian Unity Personal Financial Services Ltd does not guarantee the accuracy or completeness of the information. Australian Unity Personal Financial Services Ltd does not guarantee any particular outcome or future performance. Australian Unity Personal Financial Services Ltd is not a registered tax agent. If you intend to rely on any tax advice in this document you should seek advice from a registered tax agent. Australian Unity Personal Financial Services Ltd ABN 26 098 725 145, AFSL & Australian Credit Licence No. 234459, 114 Albert Road, South Melbourne, VIC 3205. This document produced in November 2013. © Copyright 2013.