resources

What is negative gearing?

Negative gearing is when you borrow to invest and the income you earn from your investments is less than the interest you pay on the loan, thus giving you a cashflow shortfall.

How does negative gearing work?

Here’s an example with a person borrowing $100,000 to invest:

Interest cost at 7% p.a.: | $7,000 |

Investment income at 4% p.a.: | $4,000 |

Cashflow shortfall: | $3,000 |

Tax deduction on shortfall (tax rate 38.5%): | $1,155 |

After tax shortfall: | $1,845 |

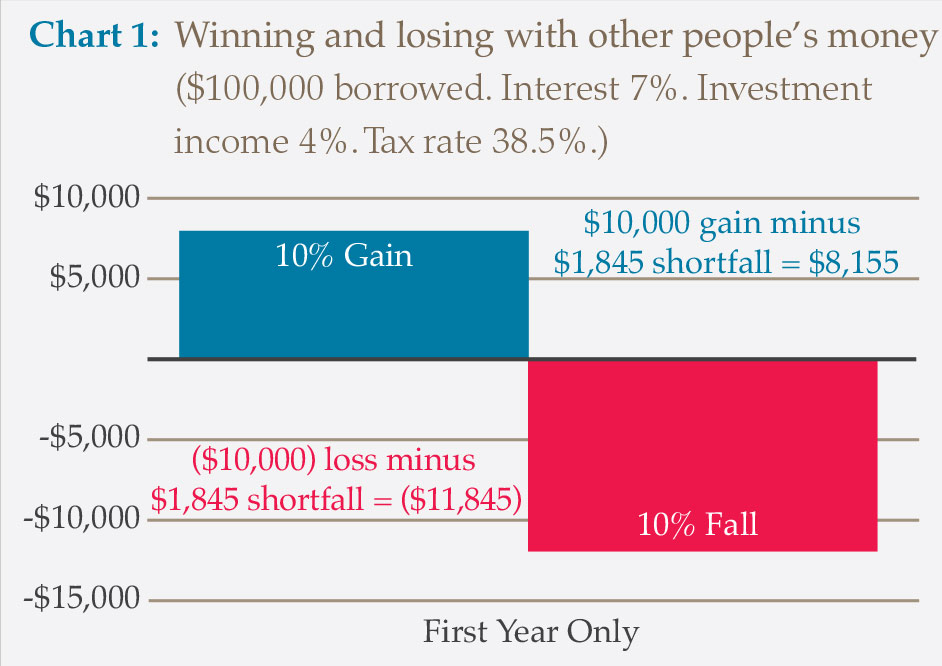

Gearing magnifies losses and gains

When you borrow to invest, your gains are magnified because someone else’s money was used to create the gain. So, using our negative gearing example from above, if you borrow $100,000 and your investment appreciates by 10% in the first year, you would be ahead $10,000 – less the $1,845 cashflow shortfall. It’s a $8,155 gain, as shown in Chart 1 opposite.

It works the same in reverse – with a 10% fall in the first year resulting in a loss of $11,845, as shown in Chart 1.

The message here is you need to understand the full range of possibilities with a gearing strategy.

And you should only invest in quality growth assets with potential for solid capital growth over the long term.

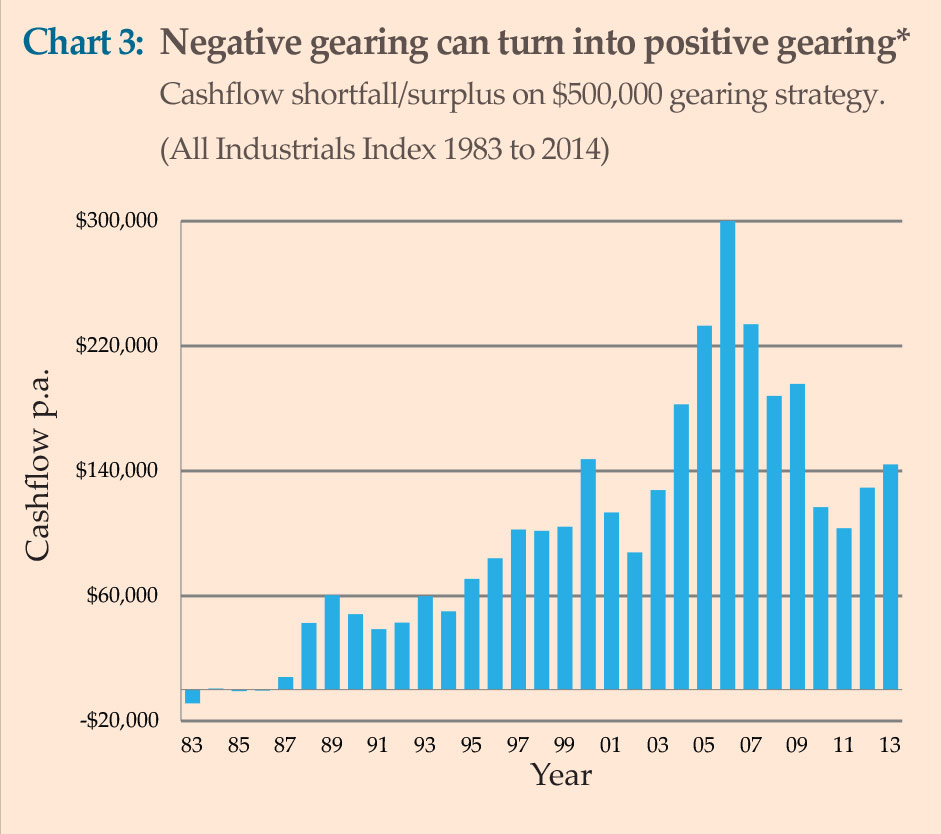

Because it is capital growth which drives a gearing strategy. For a negative gearing strategy to be

successful, your investments need to generate – over the long term – sufficient capital growth to more than cover the total cashflow shortfall (after tax) as well as tax on the capital gain.

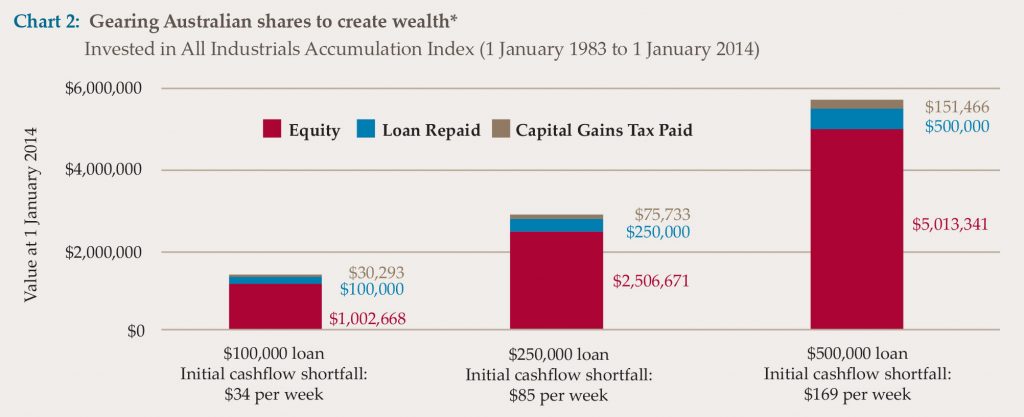

Case study: Create wealth of $5,013,341 for $169 per week

Let’s look at an historical example of a successful gearing plan.

In Chart 2 we have someone who borrowed $100,000 on 1 January 1983 and invested it in Australian shares.

By 1 January 2014 they would have created wealth of $1,002,668, after repaying the $100,000 and paying tax on

| $62,083 |

| $40,071 |

| $22,012 |

| $8,805 |

| $169 per week |

*Assumptions: All Industrials Price and Accumulation Indices to 31/12/01 and the S&P/ASX XNJ and XNJAI Price and Accumulation Indices thereafter. Dividends 80% franked from the inception of franking. The top marginal tax rate at each year has been used. Interest calculated using RBA’s Banks Variable Housing Loan Rates. Initial interest rate: 12.42% p.a.

Past performance is not an indicator of future performance. Graphs in this document are for illustrative purposes only.

Who is Australian Unity Personal Financial Services?

We specialise in providing professional strategic advice to help you improve your current financial position and ultimately achieve your long term lifestyle goals.

Importantly, our initial advice isn’t a ‘set and forget’ service. Instead we offer you regular financial mentoring and ongoing guidance – in all aspects of your personal finances – to set you, and keep you, on the path to financial wellbeing.

Our team of experienced financial professionals can provide you with a detailed and totally tailored blueprint for financial success in any or all of the following areas:

- Financial advice

- Wealth creation

- Retirement planning

- Investments

- Superannuation

- Home loans

- Commercial loans

- Investment loans

- Equipment finance

- Car finance

- Personal estate planning

- Business estate planning

- Personal risk insurance

- Business risk insurance.

Australian Unity has a proud 170 year heritage of helping Australians create secure financial futures. This pedigree and experience, combined with our corporate strength and leading edge strategic advice capability, means we are uniquely placed to offer you high quality personal financial services… each finely tuned to your particular needs to ensure you achieve your vision of a secure financial future.

After all, your financial wellbeing is at the heart of everything we do.

Any advice in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. You should obtain financial advice relevant to your circumstances before making investment decisions. Where a particular financial product is mentioned you should consider the Product Disclosure Statement before making any decisions in relation to the product. Whilst every care has been taken in the preparation of this information, Australian Unity Personal Financial Services Ltd does not guarantee the accuracy or completeness of the information. Australian Unity Personal Financial Services Ltd does not guarantee any particular outcome or future performance. Australian Unity Personal Financial Services Ltd is not a registered tax agent. If you intend to rely on any tax advice in this document you should seek advice from a registered tax agent. Australian Unity Personal Financial Services Ltd ABN 26 098 725 145, AFSL & Australian Credit Licence No. 234459, 114 Albert Road, South Melbourne, VIC 3205. This document produced in November 2013. © Copyright 2013.